LED Lighting Alternatives - when the economics won't work

Amid all the excitement surrounding LED lighting - and there are plenty of reasons to be excited - there is also the hard reality of cost justification that customers must inevitably face and that EECO deals with in sorting out whether to recommend LEDs or another alternative that offers faster payback.

To be clear, there are good alternatives to replacing aging metal halide or other inefficient lighting with LEDs. In arriving at a financially sound decision, all the workable alternatives must be examined and evaluated. This article looks at a case history where alternatives to LEDs were considered before arriving at a decision.

Lighting ROI calculation is reality

As a side note, every customer has a financial ROI calculation that their organization will find acceptable. Investment in new lighting solutions are subjected to that calculation. Customers we talk with often arrive at a minimally acceptable payback period of less than two years on their lighting investment. Shorter payback periods are much easier to justify, especially if they can be accomplished within the current budget year.

Maintenance supervisors and plant management personnel love the idea of 'making money' on their investment in year two after an upfit project. And why shouldn't they? Investment in plant and equipment is given the same scrutiny as writing a check for new lighting. Granted, investment in things like new production equipment has a longer ROI calculation - usually in multiple years - but partially that is due to the nature of the investment. A new machine may have a lifecycle of 20 years or more, during which time it is producing a product that the company sells in the market.

Lighting investment - is the equation changing?

Lighting doesn't produce anything per se. It enables the productive activity so the metrics are different for lighting investment. And perhaps that's one of the harder issues to deal with regarding lighting. Historically, lamps needed to be replaced every 2,000 to 8,000 hours. For plants that operate 10 hours per day and use 2,000 hour rated lamps, that means changing lamps more often once than a year as below. For facilities that operate 24/7, the average life cycle of an 8,000 hour rated lamp is less than one year, the same as below.

(10hrs/day x 240 days ((standard work year)) = 2000 / 2400 hrs or ~ 10 months avg life cycle)

LEDs have to some degree changed how we have to think about lighting life cycles for two important reasons. 1) LEDs are more expensive than metal halides and fluorescents, typically from 3x to 5x the cost despite increased competitiveness by LED manufacturers. 2) LEDs last much longer, typically 50,000 hours, with some manufacturers offering 100,000 hour life cycles.

So the cost equation must be re-examined when considering a relighting project. Relamping is a slightly different story - where drop-in replacements are added to existing fixtures. This alternative also has the advantage of reducing labor to near zero, assuming facility maintenance is able to do the work. All of these options were considered in the illustration that follows.

The details of the solution

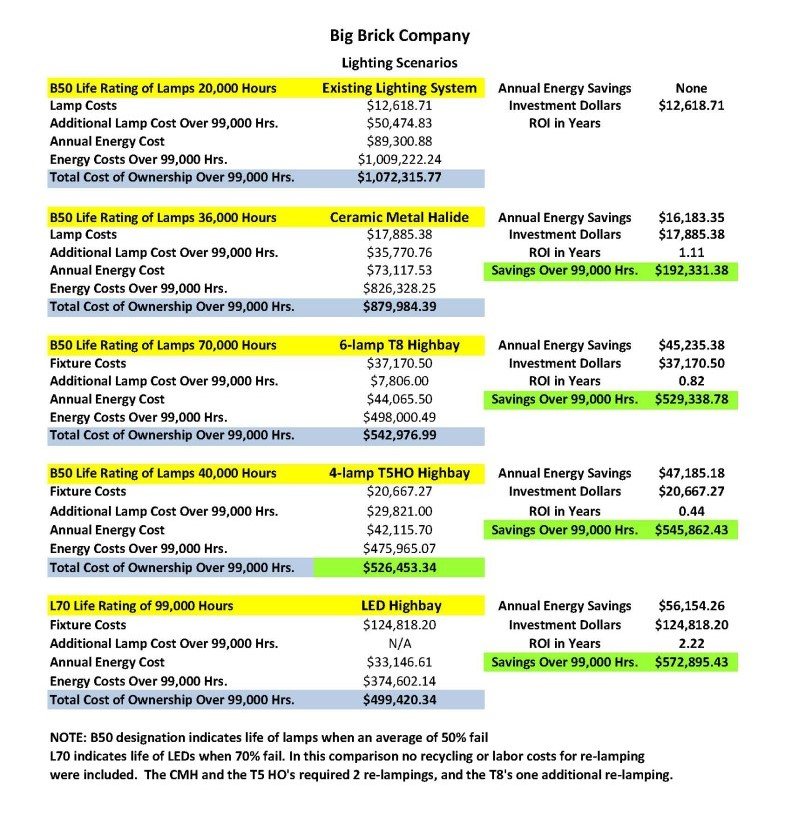

The existing lighting consisted of 359 metal halide 400W highbay fixtures. Energy costs for those fixtures ran in excess of $89,000 per year and at a reasonable cost of $.062/kWH. In many markets, that figure would be significantly higher due to increasing electric energy costs.

The solution selected for this application was the re-lighting option using 4-lamp T5 HO highbay lamps.

Note the Total Cost of Ownership for the T5 HO solution. It is not the lowest TCO when compared with the LED highbay solution. However, as we observed earlier, ROI is a very important factor when making an investment decision. The solution chosen had an ROI of a little over 5 months. For many customers this means the cost can be absorbed in one fiscal year AND the cost savings can begin to be felt. By year two in the calculation the lighting investment is 'making money' for the facility.

Note that the LED solution had an ROI of two years plus, more than two budget cycles. Our customers often say that two years really strains the organization and often is simply not acceptable.

In this particular case, the chosen solution provided adequate lighting output with significant energy savings - $47,185 per year and with a long enough life - 40,000 hours - that re-lamping would be required only twice within the period indicated. This customer was also willing to assume the cost and effort of re-lamping as the T5 lamps failed.

Every situation is unique when it comes to relighting a facility, just as every company's acceptable ROI calculation is unique. Use our example above to calculate your lighting investment and you might be surprised at what you find.